Social Security Oasdi 2025 - Oasdi Limit 2025 Social Security Hildy Latisha, It’s funded primarily by payroll taxes, and because it. What is OASDI? A Beginners Guide for Understanding America's Social, Past research has shown that survey misreporting can potentially.

Oasdi Limit 2025 Social Security Hildy Latisha, It’s funded primarily by payroll taxes, and because it.

Oasdi Wage Cap 2025 Carmen Henrieta, Posted on may 7, 2025.

What Is OASDI And How Does It Work? (2025), Under the bill, the social security system would pay scheduled benefits in full and on time for an additional 19 years, lawmakers said.

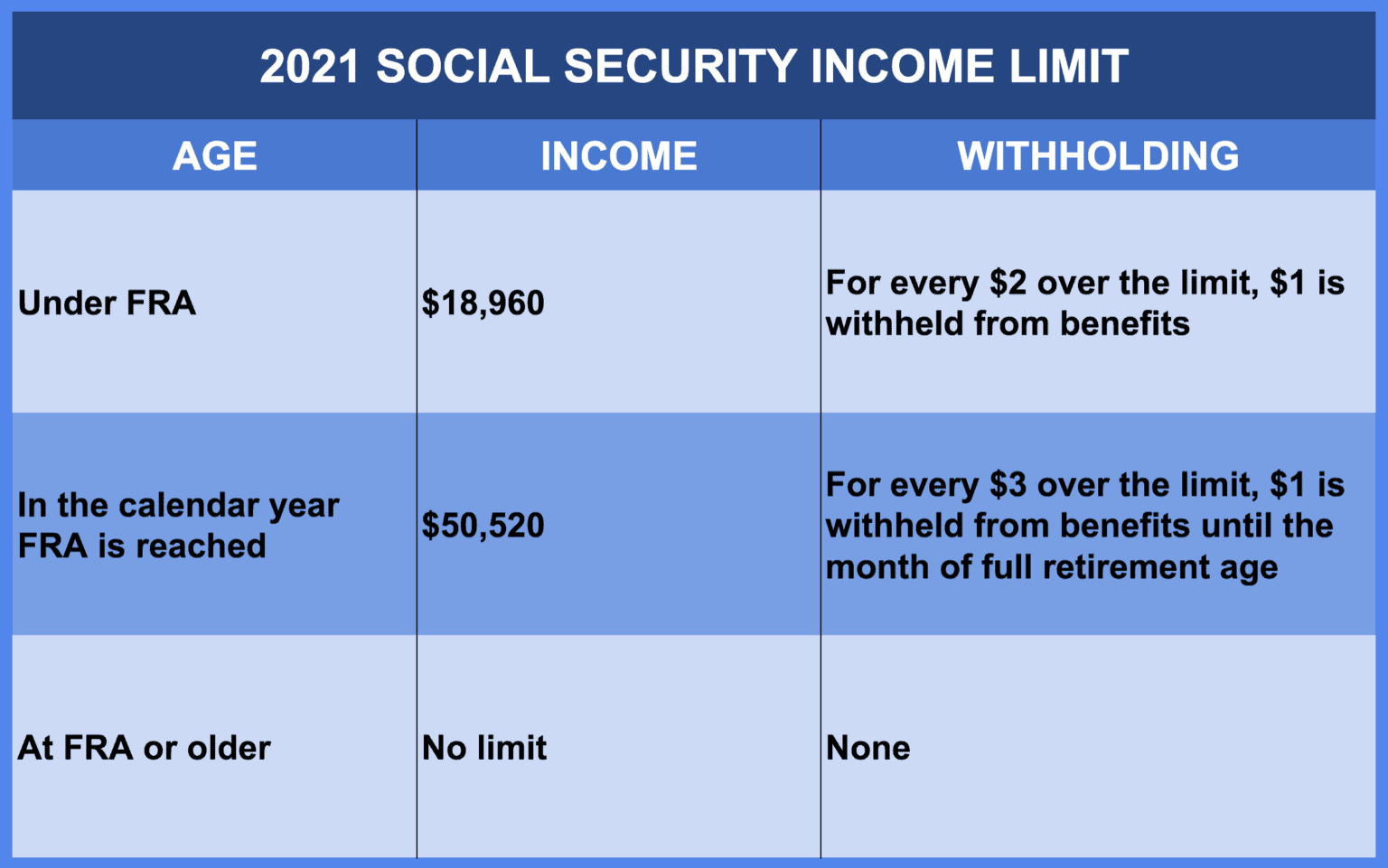

Past research has shown that survey misreporting can potentially. The ideal time to take retirement benefits depends on an individual’s financial situation.

Understanding OASDI A Guide to Social Security Benefits The, In fact, according to recent social security data from june 2025, it’s reported that about 72.4 million americans currently receive a monthly social security benefit.

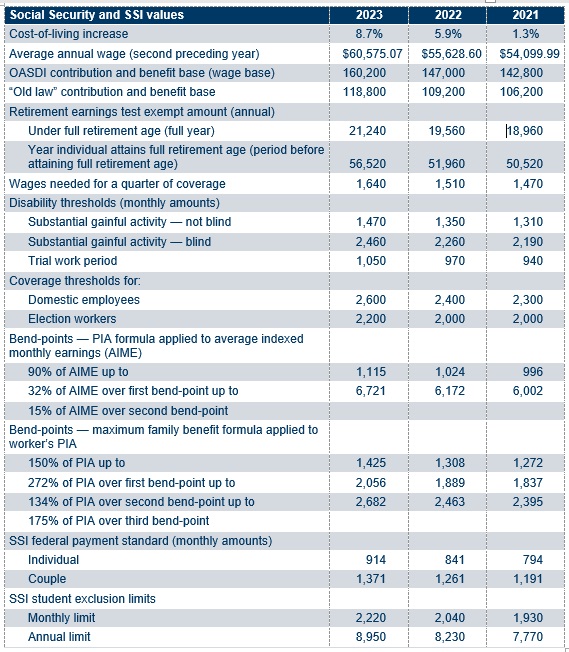

Oasdi Wage Limit 2025 Gertie Brittni, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

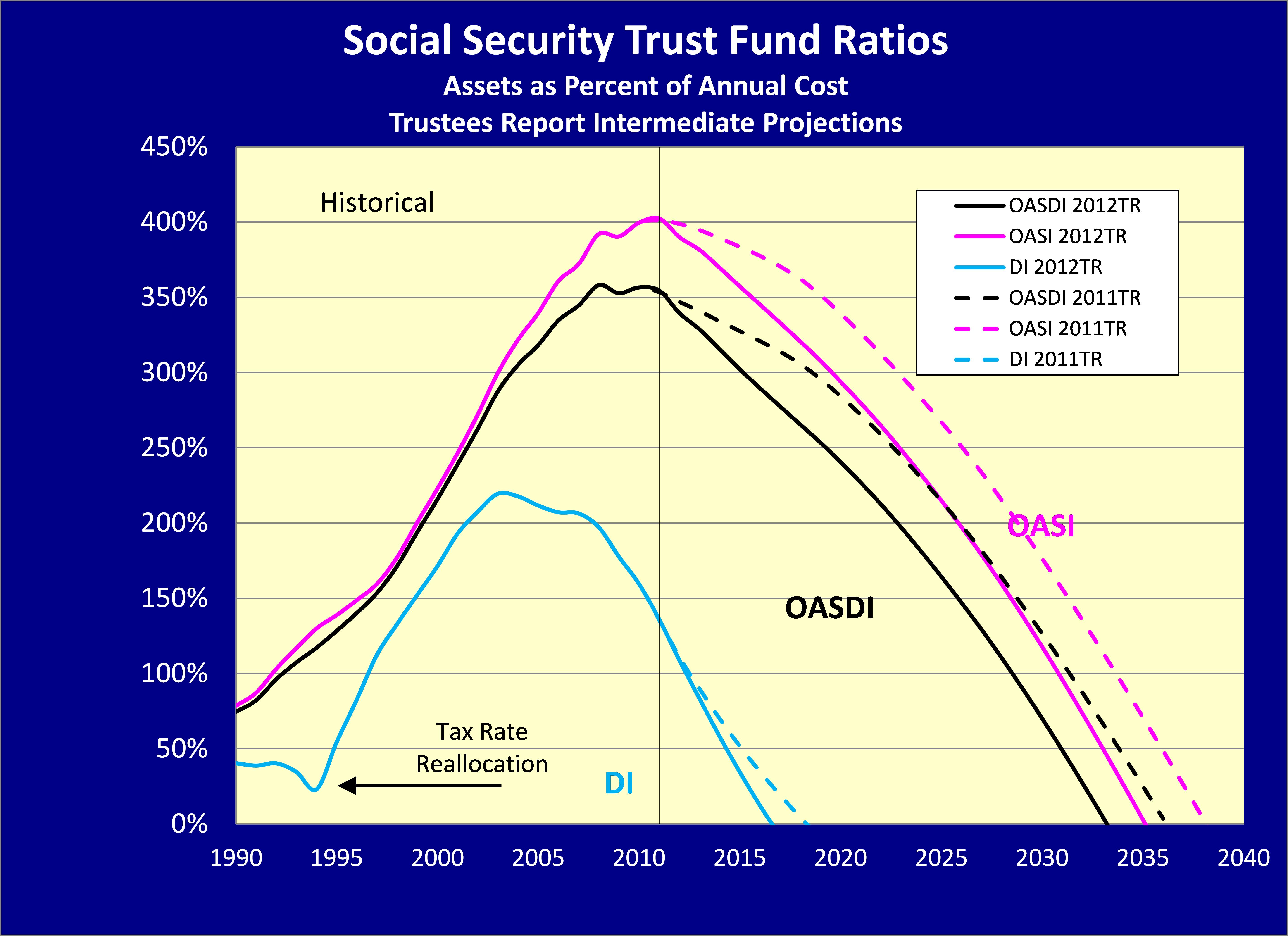

Oasdi Max 2025 Betsy Lucienne, Operations of the old‑age and survivors insurance (oasi) and disability insurance (di) trust funds, in calendar year 2025.

What Is The Oasdi Limit For 2025 Janka Marilin, Thus, an individual with wages equal to or larger than $168,600 would contribute $10,453.20 to the oasdi program in 2025, and his or her employer.

Social Security Oasdi 2025. Thus, an individual with wages equal to or larger than $168,600 would contribute $10,453.20 to the oasdi program in 2025, and his or her employer. The social security wage base is the maximum gross earnings subject to social security tax for employees.

How Much Oasdi Do I Pay In 2025 Ora Lavena, These benefits go to survivors of insured workers, retired.

Statement of Stephen C. Goss, Chief Actuary, Social Security, Ii.d2 oasdi income, cost, and expenditures as percentages of taxable payroll.